STEP 1: What is the Self – Employed Tax Credit/REFUND (SETC)

We have all heard the advertisements on the radio & tv for the Employee Retention Tax Credit (ERC). But unfortunately, the ERC program can’t help all companies or business owners. Those who are self-employed, 1099 subcontractors or small family operated businesses most likely did not qualify for the ERC and were turned away.

Thankfully, The Self-Employed Tax Credit / REFUND (SETC) also known as the Sick & Family Leave Act Tax Credit may offer self-employed business owners’ great financial relief. Up to $32,220!

If you filed a “Schedule C and/or Schedule SE” in your Federal Tax Returns for the years 2020 & / or 2021; you may qualify for the self-employed tax credit.

Typically, 1099 subcontractors, sole proprietorships, & single member LLC’s may qualify. Take a look at your federal tax returns (form 1040) (not state) for 2020 & 2021 and see if you filed a “Schedule C or Schedule SE”.

If you did, continue to the next step; if you don’t have a “Schedule C or Schedule SE” filed then unfortunately you would not qualify.

We have automated this ENTIRE process to keep the process streamlined and our fee as low as possible. Follow the next steps and be sure to read the frequently asked questions.

STEP 2: I confirmed I did file a “Schedule C and/or Schedule SE” in my federal tax returns for 2020 & / or 2021. Now let’s learn about THE PROCESS.

During the pandemic millions of people got sick from COVID. For many self-employed business owners, they were sick with COVID, had COVID like symptoms, had a COVID related illness or were told to quarantine because they were exposed or affected by COVID and were unable to work. Maybe you also had to care for a loved one affected by COVID; like a spouse, elderly parent, son/daughter or other person which prevented you from working. If your child’s school or daycare was closed or shutdown which prevented you from working then this program may be for you.

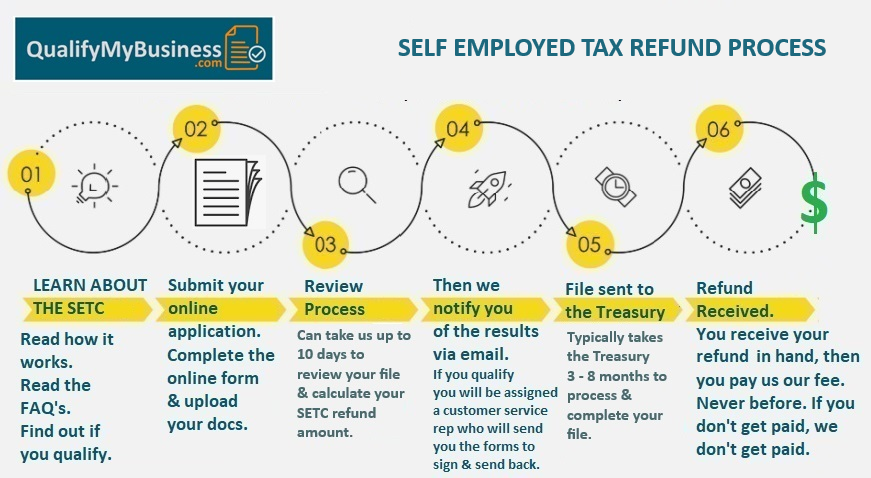

Here’s the process:

#1. Go to the “START MY APPLICATION” button. It will take you to a list of questions that will help us determine if you qualify for this program. There are 6 Sections/Questions on the application form. Obviously, the more questions that apply to you the larger your SETC refund could be.

#2. After the questions, it will ask you to submit copies of your Personal Federal Tax Return for 2020 & 2021 to our system. The reason why we ask you for your Federal Tax Returns is because we must review the numbers on your filed Schedule C’s, Schedule SE’s and other pertinent data on your tax returns which works towards the calculations on determining how much of this $32,220 tax credit you may qualify for. If you feel more comfortable with sending your filed tax returns with your social security or EIN number(s) crossed out in black marker that is completely okay. We don’t need your social security # or EIN in order to run the initial qualifying calculations. Please keep in mind, if you do qualify for the SETC refund, and want to move forward with claiming your refund we will need your social security numbers on the documents; as they are required (you amend your personal federal tax returns to claim the refund and your federal tax returns have your social security numbers on them); so we will be asking for that information later on. Some people choose to cross out the numbers and others simply upload their returns; either way works for us. Remember to upload the complete federal return for 2020 & 2021; do not just submit your Schedule C or Schedule SE. Your Complete Personal Federal Tax Return(s) must be uploaded. Not your business tax returns, your personal federal tax returns that include your (1040 forms in them); that is how you know you are sending the correct documents.

#3. Once you submit your complete application & your 2020 & 2021 federal tax returns our team will complete the calculations to determine how much of the $32,220 SETC refund you qualify for. It typically takes us less than 10 days to complete. Most client files are calculated in 1-2 days; it just depends on how complicated your file is. We will email you the results once the calculations are completed.

The beautiful part of this process is you pay NOTHING upfront. We do all the calculations and see if you qualify all free of charge. Once the calculations are completed, we will email you what SETC refund amount you may qualify for. Here’s the 3 possible outcomes:

Outcome A:

We inform you after looking at the results you do not qualify for the SETC.

Outcome B:

If your file comes back with a Tax Credit Refund LESS than $2,000; we will email you that you qualify for the credit, however, we can’t process the tax credit for you. An amount to file this small we cannot sustain on a continguency model.

Outcome C: WHAT WE HOPE!

If your file comes back with a Tax Credit Refund of $2,000 or MORE and you want to proceed with filing for the Self Employed Tax Credit. We will asigned you a customer service representative & they we will email you our service agreement to complete; which gives us permission to process your file.

STEP 3: You Qualify = Finals Steps

Congrats! You received an email stating your refund is $2,000 or MORE! Now you want to proceed with filing.

#4. A customer service representative will be assigned to your file to answer any questions you have. They will send you our service agreement to e-sign.

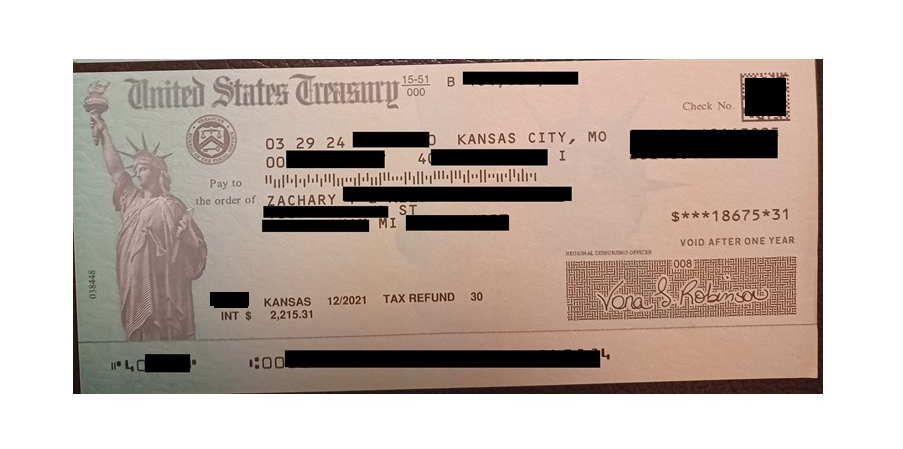

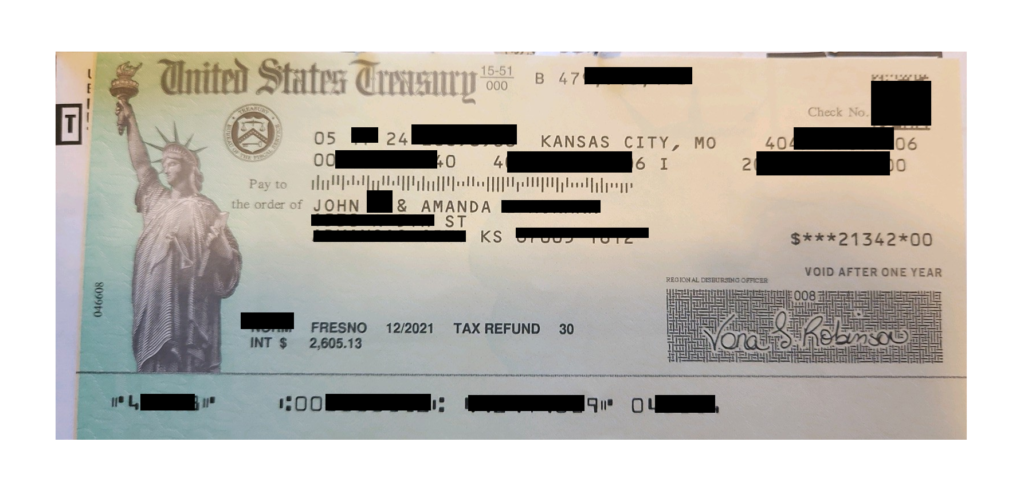

#5. Sign our service agreement. Our service agreement gives us permission to prepare the documents to file. Also, it clearly outlines our FEE for our services. We get paid nothing upfront, we simply collect a percentage of what you receive once you receive your SETC refund in hand. Our fee is 25% of the TOTAL SETC received, paid to us AFTER you receive your refund in your hands. The Treasury will issue your refund to your home address and send you the entire full amount; nothing is sent to us. Once you receive your SETC refund, you will notify us that you received the refund; then we will invoice you for 25%. For example, John is qualified for a $5,000 SETC refund. We submit his documents for the SETC refund. On average it takes 3 – 8 months for the Treasury to process his file. He receives his $5,500 SETC refund check in the mail ($5,000 which was submitted plus the IRS/Treasury will ADD interest (in this example: $500 in interest) onto the money so the refund will come back higher; as long as you don’t owe any back taxes/child support). John notifies us via email and then we will invoice him for 25% of the Total SETC refund received ($5,500); our fee is equal to $1,375, paid to us after John received his refund check in hand.

After your service agreement is e-signed by you; then your customer service representative will then send you the documents to sign for your SETC filing. They will email you the documents you will need to print out and sign; and then mail back to our office. You will have to print them out, sign them with a blue pen and mail them back to our office. Once we receive them back from you, we will then mail your documents to the Treasury, typically within 48 hours and provide you with a tracking number confirming they have been mailed.

#6. Now we wait. Once we have sent your filing to the Treasury it typically takes the government 3 – 8 months to review your file and mail you your refund. Unfortunately, they move slow and we cannot control how fast the Treasury/IRS processes files; some clients get paid quickly (within 4 months) others it can take up to 8 months; in rare cases even longer. Again we can’t control the speed of how fast the Treasury/IRS processes files.

Start My Application

PLEASE READ the Frequently Asked Questions below, they will answer 99.9% of your questions.

Frequently Asked Questions

How is the SETC refund calculated?

The SETC refund is calculated based on your income reported on your Schedule C &/or Schedule SE and the number of Sections (sections 1 – 6) on the application that apply to you. For example, if John & Sue make the same income, but John sees Sections/Questions 1 – 4 on the application form apply to him and Sue sees only Section/Question 1 only applies to her; then John’s SETC refund would be much larger than Sue’s because he had 4 sections/questions of the application that applied to him while Sue only had 1 section/question apply to her.

Is this a loan?

No. This tax credit is not a loan. There is no interest rate. There is nothing to pay back. You can use the money any way you like.

Is the Self Employed Tax Credit / Refund taxable?

The refund you receive is NOT taxed. ONLY the interest added to your refund is taxable. For example. John qualifies for a $5,000 refund, the IRS/Treasury sends him a refund check for $5,500. The extra $500 John received is interest added to the refund amount. That $500 in interest is taxable; the $5,000 is NOT.

Both my spouse & I each file a Schdule C in our Federal Tax Returns – can we both apply?

Yes, when you go to the application form on our website click the option “I have 2 Schedule C’s” and both you and your spouse complete the form and answer the questions together.

What if I took PPP, ERC or an EIDL, can I still qualify?

Yes, if you got PPP, ERC or EIDL you can still qualify for this tax credit.

How is the SETC refund received?

You may get 1 refund check or 2 refund checks. The SETC is broken into 2 years: 1 check for 2020 & 1 check for 2021. Based on your filed tax returns for 2020 & 2021 and the questionaire in your application it will determine if you are getting a refund for both years, just 1 year or none at all. Also, if you are entitled to a refund for the SETC the government will add a little interest money to the check or checks. For example, John submits his application and it is determined he qualifies for a $10,000 SETC refund. $4,000 for 2020 & $6,000 for 2021. We file his tax documents and 3 – 8 months later he receives 2 checks: $4,150 for 2020 & $6,250 for 2021; that extra money is the interest the Treasury adds to the refund. So John received a total SETC refund of $10,400; after he receives the money John will pay us our 25% which is $2,600 in this example.

How long does the process take?

Once we file your documents with the Treasury it typically takes 3 – 8 months for the government to process your file and mail you your refund check. Unfortunately we can’t control how quickly the IRS/Treasury processes files; some clients get their refund quickly (3 – 4 months), others may take up to 8 months, some clients may take even longer. We have no control over the IRS/Treasury and their processing times. Remember we don’t get paid until you get paid.

What if I am a Sub S Corp or C Corp and file a K1 (not a Schedule C)?

Then unfortunately you would not qualify for this tax credit. This tax credit is only available to business owners that file a “Schedule C or have filed a Schedule SE” in their federal tax returns for 2020 and/or 2021. Remember you can always submit your application if you are unsure and we can take a look free of charge. If you don’t qualify we will tell you why you don’t and it costs you nothing.

Does every self-employed business owner qualify?

No. But millions of self-employed business owners were impacted by COVID and qualify for this tax credit. Once you submit your application online and your 2020 & 2021 federal tax returns, within 10 business days we can give you an answer on if you qualify and how much you would receive: at no upfront cost to you. We NEVER ask you for a credit card or any banking information.

What FEE do you charge?

We charge no fees to do your calculations and verify if you qualify for the program. If you indeed do qualify for the program and wish to use us to file your documents with the Treasury then we get paid a portion of what you receive. We get 25% of total refund you receive once you get paid and the check is in your hands. For example, John receives a TOTAL $5,500 SETC refund ($5,000 plus $500 in interest the IRS/Treasury adds to the amount). John agrees to pay us 25% ($1,375) of the total $5,500 refund ONLY AFTER he receives his refund in hands. Never before. We only get paid if you get paid. Think of it simply. Whatever check amount you receive in your hand we get 25% of the total check you receive.

Is there a MINIMUM size file you work with?

Anyone can submit their information so we can run the numbers. If your file comes back with a Tax Credit Refund LESS than $2,000; we will email you that you qualify for the credit however we can’t process the tax credit for you. An amount to file this small we cannot sustain on a contingency model of 25%.

What is the AVERAGE someone receives?

Every individual file is completely unique because it relies on the questions you answer on how Covid impacted you and your filed federal tax returns for 2020 & 2021. There is no average we can give. Remember, finding out if you qualify is free, simply answer the questions and upload your returns.

What specific period is this tax credit for?

It is for the year 2020 & 2021.

What if my business started in 2021 and was not around in 2020?

Then you would only submit a federal tax return for the year 2021.

What if my business started in 2022 or after?

Then you would not qualify for this program; it is only available to self employed business owners that filed a Schedule C or Schedule SE on their federal taxes for the year of 2020 and/or 2021.

I collect a W2 wage from an employer and I am 1099 or self employed through my own business; can I apply for the SETC?

Yes, as long you have a “Schedule C or Schedule SE” filed in your 2020 and/or 2021 federal tax return then you can apply. If there is no “Schedule C or Schedule SE” in your tax returns for 2020 and/or 2021 then you couldn’t apply and/or qualify.

I want to speak to someone over the phone?

Once you submit your COMPLETE application online, within 10 business days we should have an answer back if you qualify and what that amount will be. You will be emailed the information and if you qualify for this tax credit/refund you then be assigned a customer service representative. Your customer service representative will go over the amounts and answer any questions you may have. Nothing is automatically filed. But the initial process of running the numbers is all done online. It has to be automated, remember there are millions of 1099, single member LLCs, sole proprietors (anyone who files a Schedule C / Schedule SE in their tax returns for 2020 &/or 2021), all of which are looking to qualify.

I haven’t filed my tax returns for 2020 & 2021?

Then unfortunately we couldn’t help you at this time.

What if I have a tax lien, have a tax judgment or owe back taxes?

If you owe back taxes we will take on cases on a CASE by CASE basis. Typically we do NOT take a lot of back taxes owed or payment plan clients. Even if you a have a payment arrangement with the IRS/Treasury for back taxes; we unfortunately typically do not accept those applicants at this time. If you owe more in back taxes than the total SETC refund we would be, most likely we will not take the case. We get paid on contingency (after you receive your refund in hand) and since in most back tax cases your refund gets applied to the taxes you owe; you would have to pay us out of pocket once you get that refund letter notice that your SETC refund was applied to your back taxes owed. Simply put there is a significant risk you won’t pay us since you would have to pay us our 25% out of pocket. You are more than welcome to submit an application regardless so we can run the numbers. For example, maybe you qualify for a $10,000 SETC refund and you owe only $2,500 in back taxes. Once your SETC file is processed $2,500 would be deducted from your $10,000 SETC refund, $2,500 for our 25% fee goes to us and it would still leave you with a $5,000 SETC refund. Again we take back taxes, back child support payment and back alimony payment files on a CASE by CASE basis.

When does this program expire?

This tax credit is broken up into 2 years: 2020 & 2021. The credit for the 2020 year will expire in April 2024 & the credit for the 2021 year will expire April 2025.

I want to protect my privacy on my tax returns?

Absolutely, then use a black marker to cross out your EIN or social security numbers on your tax returns. We do not need that information to run the initial calculations to see if you qualify for the refund. Once the calculations are completed and if you do qualify for a refund and want us to proceed with filing; then you are required to supply us that information once your customer service representative is assigned to your file. The amended tax returns to claim the refund require the social security numbers on the documents.

Will I sign a service agreement?

Yes, but only AFTER we run your calculations to see if you qualify for this tax credit. Once we run the numbers and if you qualify for an amount and decide to move forward; then we will send you our service agreement to e-sign. It will clearly outline that we only get paid our 25% AFTER you have received your refund in hand. Never before. It also includes a personal guarantee you will be signing. Why a personal guarantee? Because we are trusting that you will do the right thing and pay us once you receive your funds. We are doing all the work on your file and trusting you will have integrity to pay the fees we are owed. You are required to notify us via email your customer service representative & info@qualifymybusiness.com within 5 days of receiving your refund in the mail.

What forms are being filed to claim this tax credit?

As of April 15, 2024, you are amending your personal federal tax return for 2021 to claim the SETC refund.

What address does the tax credit refund check go to?

100% of the refund gets mailed to you. When you fill out the application on our website it will ask you for your address. Once your tax refund is filed with the Treasury it typically takes them 3 – 8 months to issue your refund in the mail. Make sure to put your address on our online form where you are going to be living in the next 12 months; you do not want your check lost in the mail.

If I claimed this tax credit already, can I apply again?

No, you can only apply one time for this tax credit.

When you say “tax credit”, is it actual money we get?

Yes, if you qualify you will receive a physical check from the Treasury you can deposit and use any way you wish.

Do you sell my data?

Absolutely NOT, we do NOT sell your data or information to anyone.